ENKOTEC, a company based in Skanderborg, makes use of SME Guarantees from the Export and Investment Fund of Denmark (EIFO) to ensure sales of fully automatic nail manufacturing systems to customers all over the world.

The nail manufacturing systems consist of both stand-alone systems and fully automatic production lines and often involve orders worth several million DKK. Being able to offer customers a financing solution can therefore help to close an order and ensure that the company gets paid immediately.

Without the SME Guarantees these orders would most likely not have materialised

SME Guarantees being used actively

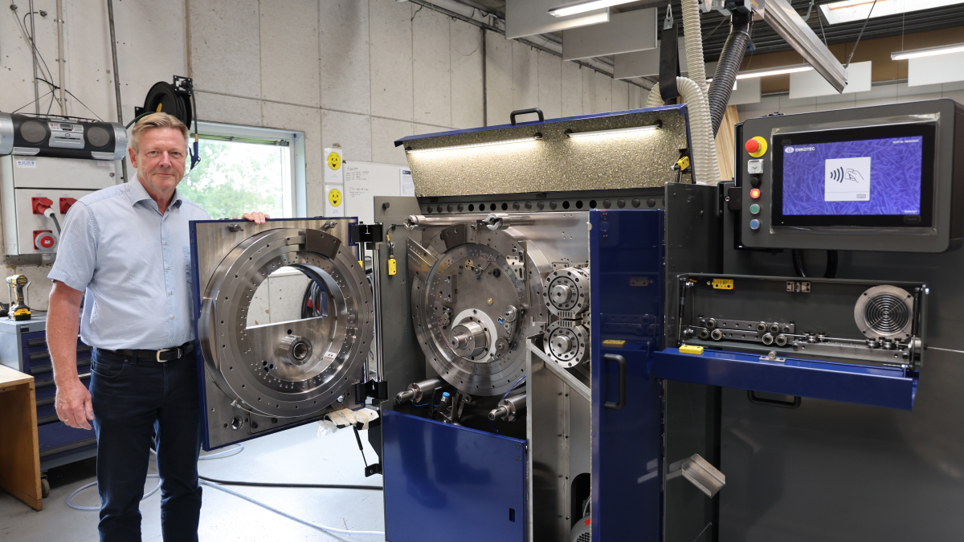

”For years, ENKOTEC has been using EIFO’s SME Guarantees which target Danish SMEs. We use SME Guarantees as an active part of our sales process because it makes it easier for the customer to obtain financing without any significant risk for our company. At the same time, we get paid immediately which is a huge advantage,” says Gert Kjeldsen, ENKOTEC’s CEO.

ENKOTEC is currently covered by eight active SME Guarantees in five countries worth a total value of approximately DKK 60 million.